5 Reminders for Weathering Market Volatility

Investing in the stock market is one of the best ways to realize fund growth over the long term. However, growth is not linear, and market downturns are an unfortunate reality. So how should you manage your investments – and your emotions – when stocks are taking a tumble?

Here are a few reminders to ease your mind:

1. FFTC pools are diversified, and diversification shines in times of market stress.

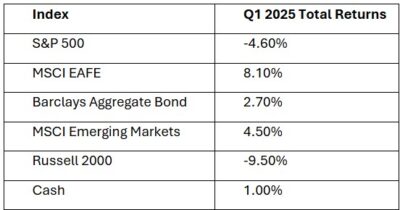

In recent years, a common question has been: “why do you own bonds or international stocks or hedge funds when the S&P 500 has beaten the returns of almost every other asset class over the past decade?” We begin to sound like a broken drum, but the data for Q1 2025 is a great example of diversification at its finest.

It’s sometimes difficult to justify diversification in strong market environments like 2023 and 2024, but when markets become turbulent investors are happy that they spread their eggs into different baskets.

2. A market sell-off in the middle of a year does not necessarily indicate prolonged negative returns.

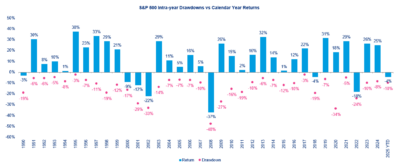

The largest one-day sell-off in Dow Jones history occurred on October 19, 1987, when the Index plunged 23% in one trading day. Surprisingly, the calendar year return for the Dow Jones Index in 1987 was 2.26%. There have been many strong calendar-year returns in the S&P 500 Index that also experienced corrections (>10% loss) along the way.

3. Large down days in the market are usually surrounded by large up days.

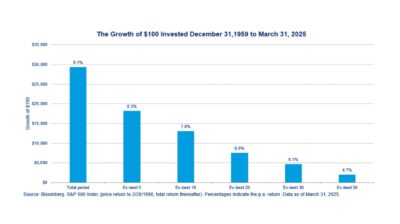

When volatility increases, the range of potential returns widens. This is painful on the downside, but the strong positive daily returns that often follow help drive long-term returns. If you sell on a down day and miss a large recovery, it may negatively affect long-term results.

Missing just a few of the best trading days can have a material impact

4. Try to put the current sell-off in perspective.

The S&P 500 has fallen precipitously in the last few weeks, but the Index is where it was only 10 months ago in May 2024. The results of prior years have been extraordinary relative to historical norms with the S&P 500 returning more than>20% in seven of the last 12 calendar years. Market volatility is inevitable but if history is any guide, staying invested for the long-term has been a successful strategy.

5. The overall economy remains on a strong foundation.

Difficult market environments tend to revolve around systemic risk embedded in the financial system. We’ve all heard the phrase “a house of cards,” and the imagery speaks for itself. A few recent examples were the regional banking crisis, COVID-19 and the Great Financial Crisis of 2008.

In our current situation, the broader U.S. economy still appears strong, and employment and corporate earnings have been robust. While trade and tariff policies matter, other policy areas (fiscal, monetary and regulation) are also important.

We aren’t out of the woods yet, but as volatility continues try to keep the prior points in mind. You can always reach out to your relationship manager or the Investments Team at Investments@fftc.org with any questions or concerns.